The Dow Jones Industrial Average (DJIA), colloquially known as "The Dow," is one of the most watched stock market indices in the world. Investors and market enthusiasts are always curious about the latest record high, a benchmark that reflects the overall health and performance of the US economy. Let's dive into the fascinating world of the Dow and uncover what it represents.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks listed on the New York Stock Exchange (NYSE) and the NASDAQ. These stocks are selected by S&P Dow Jones Indices to represent various sectors of the US economy, providing a snapshot of the market's performance.

The index has been a symbol of the American economy for over a century. It's no wonder that investors keep a close eye on it. But what exactly is a record high for the Dow, and what does it signify?

The Dow's record high is the highest closing price ever recorded in the index's history. This benchmark is often seen as a sign of confidence in the market and the overall strength of the economy.

As of October 2021, the Dow's record high stands at 36,739.20 points. This record was reached on January 4, 2022, after a strong run in the stock market that began in 2020.

Several factors contribute to the Dow's record high. Here are a few key factors:

1. Economic Growth: Strong economic growth often leads to higher corporate profits, which in turn boost stock prices. 2. Earnings Reports: Companies that exceed market expectations with their earnings reports can push the index higher. 3. Interest Rates: Changes in interest rates can impact the market. Lower interest rates typically encourage borrowing and spending, which can drive up stock prices. 4. Market Sentiment: Investor sentiment can greatly influence stock prices. When investors are optimistic about the market, they tend to buy more stocks, pushing prices higher. 5. Technological Advancements: Technological advancements can lead to increased productivity and profits, benefiting companies listed in the Dow.

Case Study 1: In March 2020, the Dow experienced its worst decline since the Great Depression due to the COVID-19 pandemic. However, within a few months, the index recovered and reached a new record high. This rapid recovery highlights the resilience of the stock market.

Case Study 2: During the financial crisis of 2008, the Dow lost more than 50% of its value. However, the index eventually recovered and reached a new record high in 2013, reflecting the economy's gradual recovery.

The Dow Jones Industrial Average's record high is a significant milestone in the world of finance. It signifies confidence in the US economy and the stock market's resilience. As investors and market enthusiasts continue to watch the Dow, it's important to consider the various factors that influence its performance and record highs.

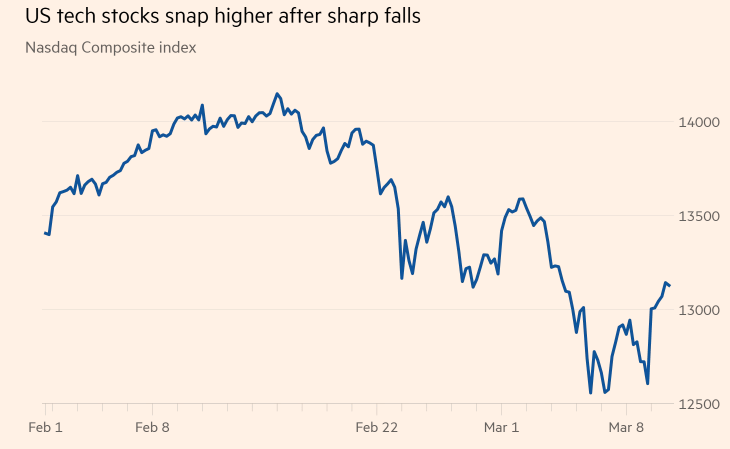

nasdaq composite